Vietnam MICE Suitability Test for MICE Planners | Risk

When Vietnam Is the Right Choice for MICE - and When It Isn’t

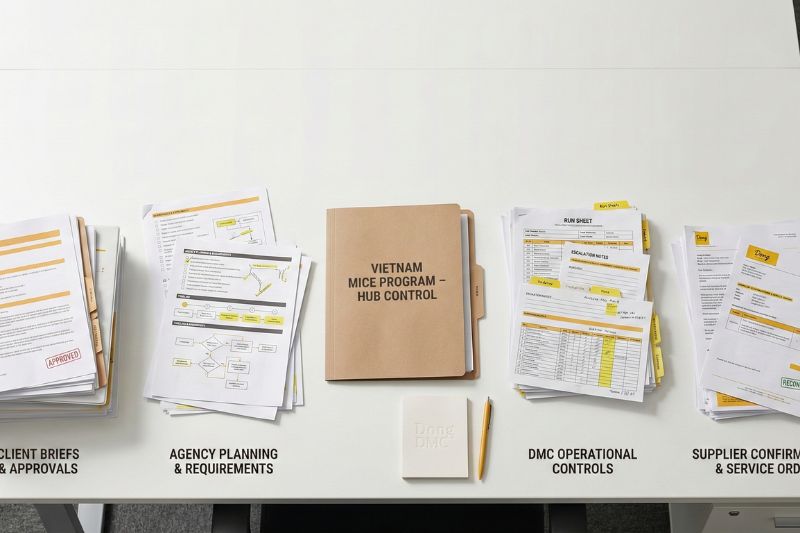

When evaluating When Vietnam Is the Right Choice for MICE - and When It Isn’t, travel professionals need more than venue lists-they need role clarity, governance, and a defensible decision trail. This actor-specific reference frames where responsibility sits between end client, agency, DMC, and local suppliers, and how that affects risk ownership in Vietnam’s primary hubs versus secondary locations. The goal is to clarify what can be safely delegated, what must be approved, and which execution risks require documented controls before committing to dates, cities, and delegate volumes.

1. Context and relevance for When Vietnam Is the Right Choice for MICE - and When It Isn’t

- Why Vietnam is frequently shortlisted for Asia MICE: Vietnam is commonly considered for MICE programs when planners can anchor delivery in established hubs such as Hanoi and Ho Chi Minh City, supported by maturing meetings infrastructure and policy signals such as visa easing.

- Why suitability is uneven by geography: Predictability tends to be higher in primary hubs, while secondary locations may present greater variance in infrastructure capacity, supplier depth, and exposure to seasonal disruption. Suitability therefore depends on where the program places its operational “center of gravity.”

- What “right choice” means for agents, tour operators, MICE planners, and incentive buyers: A “right choice” is a selection that can be defended internally and to the end client-through a clear RFQ scope, explicit ownership assignments, and documented control measures that reduce gray areas during incidents.

- What “isn’t” means in practice: Vietnam may be a weaker fit for programs that require uniform nationwide delivery standards, dispersed routing across multiple non-hub locations, or high scalability outside Hanoi/Ho Chi Minh City without increased contingency design and governance overhead.

- Decision posture this article supports: Governance-first program design (ownership map + documentation) rather than “best-effort” delivery assumptions-especially when stakeholder scrutiny, duty-of-care, and auditability are non-negotiable.

2. Roles, scope, and structural considerations

Core definition set for shared language in RFQs and briefing packs

- Meetings: Typically small to medium business gatherings where agenda control, meeting room flow, and punctual transfers are primary concerns.

- Incentives: Reward-driven programs where participant experience is prominent, and risk exposure often increases when routing is dispersed or outdoor-dependent.

- Conventions: Larger formats where plenary capacity, registration flow, concurrent breakout management, and robust incident governance become central.

- Exhibitions: Trade-show formats where loading access, contractor coordination, and compliance with venue rules can become critical schedule dependencies.

Responsibility boundary model for Vietnam group travel and events

- End client: Owns event objectives, budget approvals, duty-of-care policy, and final escalation authority for participant welfare decisions.

- Agency: Owns global coordination, RFQ issuance, audit trail, and change control governance (including how approvals are recorded).

- DMC: Owns on-ground execution, local compliance interface, supplier coordination, and mitigation planning within contracted scope.

- Suppliers: Own service delivery, disruption reporting, and service recovery within contracted scope (venues, hotels, transport operators, production vendors).

Structural considerations that affect role boundaries in Vietnam programs

- Hub concentration: Hanoi and Ho Chi Minh City commonly operate as primary control environments, with stronger coverage across venues, international hotel inventory, clinic access, and transport options.

- Secondary locations: Outside hubs, planners should expect greater variance in infrastructure and supplier depth, and potentially higher sensitivity to weather and routing disruptions.

Responsibility/ownership map as a planning artifact (what it must cover)

- Which party approves: Dates, city selection, venue class, delegate thresholds, and contingency budgets.

- Which party executes: Manifests, transfer plans, service confirmations, and local compliance checks.

- Which party documents: Sign-offs, incident logs, and post-event audit notes.

Where the main keyword applies operationally: “Right choice” decisions are only stable when ownership can be clearly assigned and enforced through contracts, RFQ language, and run-of-show governance. If ownership is ambiguous, Vietnam (or any destination) becomes harder to defend when disruptions occur.

3. Risk ownership and control points

Where failures typically occur in Vietnam MICE delivery (governance view, not tactics)

- Arrival/aviation disruption

- Accommodation allocation failures (overbooking, rooming mismatches)

- Medical events requiring duty-of-care escalation

- Road transport disruptions (breakdowns, traffic delays)

- Weather impacts affecting outdoor elements

- Supplier no-shows that require immediate substitution

Stage-based control points and ownership logic (before / during / after)

- Pre-event: Ownership map embedded in RFQ, confirmation deadlines, SLAs, escalation ladder, and documented authority to approve change.

- Live event: Incident reporting cadence, decision rights to change program, and participant welfare escalation aligned to duty-of-care policy.

- Post-event: Audit trail completeness, lessons-learned loop, and dispute documentation packaged for internal review.

Canonical risk scenarios with primary owner, secondary support, and required evidence trail

| Scenario | Primary owner | Secondary support | Required evidence trail |

|---|---|---|---|

| Flight disruption / late arrival | DMC coordinates on-ground recovery (airport transfers, regrouping) | Agency liaises globally (airline touchpoints, client comms alignment) | Flight manifest, revised transfer plan, time-stamped updates in shared tracker |

| Hotel overbooking / rooming mismatch | DMC manages allocations and resolution with property | Supplier confirms blocks; agency approves relocation decisions | Block confirmations, cut-off dates, signed rooming list version, approval record for relocations |

| Medical incident | End client leads duty-of-care decisions | DMC coordinates local response (transport, facility access) | Consent documentation, reporting chain timestamps, incident summary aligned to duty-of-care policy |

| Coach breakdown / traffic delay | DMC owns operational continuity | Supplier provides replacement per contract | Service failure record, replacement dispatch time, revised routing/ETA log |

| Weather disruption | DMC monitors and recommends mitigations | Agency/client approve program changes | Forecast basis, decision log for program change, revised run-of-show with approvals |

| Supplier no-show | DMC activates backups | Agency enforces contractual remedies | No-show confirmation, backup activation record, SLA breach documentation |

Preventive controls that should be visible to all parties (for governance credibility)

- Shared risk matrix: Owners, triggers, escalation timeframes, and decision rights (who can authorize what).

- Change-control triggers: Delegate variance, date shifts, venue changes, and newly identified infrastructure gaps requiring written re-approval.

- Minimum documentation standard: Incident log fields, daily sign-offs, and post-event audit timing agreed in advance.

4. Cooperation and coordination model

Communication architecture between agency, DMC, and suppliers (handoffs and accountability)

- Single source of truth: A controlled briefing pack + run-of-show + shared incident tracker reduces conflicting instructions and undocumented changes.

- Escalation ladder: Define who is notified, who can approve changes, and how approvals are recorded (email, signed addendum, or agreed digital approval method).

- Version control: Updates to manifests, rooming lists, and program flows should be distributed with version IDs and explicit acknowledgement requirements.

Governance rhythms that reduce ambiguity during live operations

- Pre-event alignment: Risk briefing and “boundary test” to validate what happens if a critical dependency fails (venue access delay, weather shift, flight misconnect).

- On-site cadence: Daily check-ins, sign-offs, and defined decision windows for program adjustments so changes do not occur by assumption.

- Post-event governance: Audit trail package and lessons learned shared within an agreed timeframe, aligned to procurement and internal reporting needs.

Operational/logistics section: what planners must require from on-ground coordination (without tactical detail)

- Transport and routing assumptions in major cities: Treat traffic variability as a known constraint that requires buffers, decision windows, and documented contingencies.

- Venue access and loading/guest flow considerations: Access constraints can create schedule risk; require the run-of-show to reflect realistic access, registration, and movement assumptions.

- Supplier redundancy expectations: Backup rosters and confirmation discipline should be explicit, including how substitutions are authorized and documented.

Partner success/case-study potential (generic, non-promotional)

- What makes a program “auditable”: Clear ownership map, recorded approvals, and documented service recovery actions tied to agreed SLAs.

- How agencies can convert clean governance into internal/client confidence: Standardized incident reporting and post-event audit formats reduce interpretation risk and support defensible decision-making without relying on informal assurances.

5. Decision confidence builder for agency-and-travel-industry-resources: A hub-first suitability test for Vietnam MICE programs

Step 1: Fit assessment (city strategy)

- Hub-first (Hanoi / Ho Chi Minh City) program profile: Typically offers higher predictability for larger delegate counts and complex agendas because critical services and escalation options are more concentrated.

- Non-hub or multi-stop profile: Flag capacity and seasonality risks early; require stronger contingency design and explicit client approvals for the additional exposure created by dispersed routing.

Step 2: Scale and complexity gates (what must be validated before committing)

- Delegate volume thresholds that trigger additional governance: Use agreed thresholds to require additional sign-offs, deeper supplier checks, and tighter change-control rules (threshold levels should be defined by the buyer’s governance model and risk tolerance).

- Venue suitability logic: Convention centers and large hotels in hubs may better support complex flows; secondary markets may introduce constraints that need earlier validation and stronger contingency design.

- Medical access expectations: Proximity and access to appropriate medical facilities should be treated as a duty-of-care input, not an afterthought.

Step 3: Boundary test (what changes the risk classification)

- Outdoor-dependent incentives in central regions during higher weather-risk windows: Require indoor alternatives, a pre-agreed decision timeline, and explicit authority to cut or replace elements.

- Dispersed routing: Increases exposure to transport variability and supplier depth limits; require tighter routing governance and stronger documentation for each dependency.

- Programs requiring uniform service standards across multiple provinces: Treat this as a governance escalation, because uniformity is harder to enforce without additional controls, audits, and contingency budgets.

Step 4: Decision documentation package (what buyers can show internally)

- Suitability rationale: Why Vietnam is selected (or constrained) for the specific event type, routing model, and stakeholder expectations.

- Ownership map + risk matrix + change-control rules embedded in the RFQ: Ensures approvals and accountability are designed-in, not retrofitted during incidents.

- Verification checklist: Visa rules currency, infrastructure assumptions for secondary cities, and supplier SLAs confirmed via written acceptance.

Generic scenarios (for planning justification, not storytelling)

- 1,000-delegate convention in Hanoi: Hub-based delivery with predefined escalation and documented backups for traffic delays, aligned to the ownership map and incident logging standard.

- Dispersed incentive in central Vietnam: Weather disruption forces indoor alternatives or program cuts, escalating to client decision authority under pre-agreed change-control rules.

6. FAQ themes (questions only, no answers)

- Who owns duty-of-care decisions in Vietnam MICE programs: the end client, the agency, or the DMC?

- What escalation path should be written into an RFQ for flight disruptions and late arrivals?

- What documentation should agencies require to prevent (and resolve) hotel overbooking or rooming mismatches?

- Which risks are typically operational (DMC-owned) versus strategic (client-owned) in Vietnam events?

- What change-control triggers should require written re-approval (delegate count, dates, venue, routing)?

- How should incident logs be structured to support post-event audits and dispute resolution?

- When does Vietnam become a higher-risk choice for incentives compared with hub-based meetings or conventions?

- What must be verified before booking secondary cities in Vietnam (infrastructure, supplier depth, seasonal constraints)?

- How should agencies validate supplier SLAs and backup rosters without duplicating the DMC’s operational role?

- What is the minimum governance pack a planner should circulate (briefing pack, risk matrix, escalation ladder, sign-offs)?

EN

EN