Vietnam Tourism Governance for Group & MICE Planners

How Vietnam’s Tourism Structure Affects International Group Planning

Vietnam’s inbound market is scaling alongside a governance model that centralizes strategy and promotion while decentralizing delivery across provinces and suppliers. This industry-wide reference explains how Vietnam’s tourism structure affects international group planning by clarifying who governs what (VNAT vs provincial authorities), who executes what (agency vs DMC vs suppliers), and where accountability typically breaks down for international groups and MICE. The aim is to help travel professionals define responsibility boundaries early, reduce execution risk during peak national campaigns, and document decision-making in a way clients and stakeholders can audit.

1. Context and relevance for How Vietnam’s Tourism Structure Affects International Group Planning

Governance structure matters for agencies, tour operators, and MICE planners because it determines where standards are set, where permissions are enforced, and where operational decisions must be made under time pressure. In Vietnam, the planning impact is most visible at interfaces: national promotion and policy signals may be consistent, while operational conditions are implemented and enforced locally.

Vietnam’s tourism model in one sentence: centrally set priorities and branding (VNAT), locally executed operations (provincial authorities, DMCs, suppliers).

Demand pressure becomes a planning variable when national targets and promotion cycles translate into higher inbound volumes. Capacity strain, allocation risk (rooms, coaches, venues), and service variability tend to show up first in group programs because groups require synchronized inventory and predictable timing across multiple suppliers.

National campaigns affect groups disproportionately because they concentrate attention, events, and public-facing activity into specific regions and time windows. Two common signals for planners are:

- National Tourism Year focus regions (for example, Gia Lai 2026) and the knock-on effects on inventory, permissions, and event calendars.

- National event participation and promotion cycles (for example, ATF/TRAVEX) as indicators of potential demand peaks and shifting supplier attention.

Core planning decision this section supports: when to treat an issue as policy/standards alignment (VNAT) versus regional compliance and execution (provincial authority/DMC/supplier). This distinction helps agencies avoid misrouting questions (or escalation) and helps DMCs protect delivery timelines by engaging the correct local compliance owners early.

What travel professionals should verify as “system facts” before committing:

- Current national priorities being emphasized in official promotion (including MICE, coastal, cultural, and wellness segments).

- Province-specific operating conditions that can diverge from national messaging (site rules, permit lead times, enforcement intensity, and local capacity constraints).

2. Roles, scope, and structural considerations

Definitions used in industry planning documents (to standardize RFQs, contracts, and governance packs):

- Vietnam National Authority of Tourism (VNAT): Central body under the Ministry of Culture, Sports and Tourism responsible for national tourism policy, branding, promotion, and strategic planning, including MICE development.

- National Tourism Year: Government-led annual regional campaign coordinating events and attention for a designated destination.

- MICE tourism: Meetings, Incentives, Conferences, Exhibitions segment prioritized in national strategy, affecting venue pipeline, city readiness narratives, and stakeholder involvement.

Role boundaries across the group-travel value chain (industry-wide responsibility map):

- End client (corporate/incentive association buyer): Defines requirements, approves high-level plans, sets duty-of-care expectations, and accepts residual risk after mitigation options are presented.

- Agency / tour operator (sending market): Program design, participant management framework, international air, visas, insurer interface, and governance oversight across parties.

- DMC (receiving/on-ground): Supplier contracting, local permits, on-site delivery, incident response coordination, and creation of an auditable operations record.

- Suppliers (hotels, transport, venues): Contracted service delivery under local regulation; operational reporting line to the DMC during live operations.

- VNAT and provincial tourism authorities: Standards, promotion, advisories; provincial enforcement and site-specific compliance.

Structural considerations that affect planning outcomes:

- Centralized promotion vs decentralized compliance: a “national priority” signal does not automatically translate into “local permission granted” for specific sites, movement, or event formats.

- Provincial variability: operating rules, capacity constraints, and enforcement intensity can change by destination and season, and may differ across provinces within one itinerary.

- Planning implication for the main keyword: How Vietnam’s tourism structure affects international group planning becomes most operationally relevant when responsibilities are split between inbound coordination (agency) and ground execution (DMC), requiring clear decision rights and documentation standards at the handoff.

3. Risk ownership and control points

Failures in international group programs typically occur at interfaces, not within a single supplier’s scope. Common interface pressure points include: handoffs between international and domestic legs, between DMC and suppliers during live operations, and between province-level requirements and group expectations set in the sending market. Governance clarity reduces impact by ensuring the correct party is accountable to decide, act, and document.

Risk ownership framework (primary owner vs secondary supporter) aligned to accountability, not blame:

Flight disruption / late arrival

- Primary: agency (inbound coordination); secondary: DMC (re-sequencing ground program)

- Controls: confirmed flight details in RFQ; buffers; shared escalation channel; decision rights on itinerary changes

- Documentation: incident log with timestamps; revised manifests; approval trail

Hotel overbooking / rooming mismatch

- Primary: DMC (supplier contracting); secondary: hotel/supplier

- Controls: room block guarantees; allocation matrix; rooming list freeze policy; re-accommodation clauses

- Documentation: signed rooming list; waiver/comp record; resolution sign-off

Medical incident

- Primary: DMC (local duty-of-care protocol execution); secondary: agency (insurance liaison and client comms protocol)

- Controls: medical profiles handling rules; nearest facility mapping; consent and privacy workflow

- Documentation: incident form; release/consent; insurer reporting records

Transport disruption (breakdown/traffic delay)

- Primary: DMC (fleet procurement and contingency); secondary: transport supplier

- Controls: vehicle specs; driver qualification expectations; backup capacity; route/time risk assessment

- Documentation: maintenance logs; delay timeline; passenger manifests

Weather disruption

- Primary: DMC (monitoring and local pivot); secondary: authorities (advisories) and agency (change approval)

- Controls: seasonal risk matrix in briefing; indoor alternates; thresholds for cancellation vs reroute

- Documentation: alert citations; revised program; client approval record

Supplier no-show

- Primary: DMC (backup protocols); secondary: agency (schedule impacts and client approvals)

- Controls: penalty clauses; alternates roster; confirmation checkpoints

- Documentation: breach evidence; replacement confirmation; post-incident audit note

Governance-focused control points across stages (conceptual):

- Pre-contract: allocation guarantees, decision rights, escalation ladder, documentation expectations

- Pre-arrival: freeze dates, change-control triggers, data completeness checks

- Live ops: incident logging, sign-offs, authority to approve substitutions

- Post-program: audit trail retention expectations (including a minimum retention period) and compliance review triggers

4. Cooperation and coordination model

Coordination principle: align strategic priorities (VNAT) while executing through provincial and supplier networks (DMC-led). In governance terms, this means using national signals to inform planning assumptions, while treating provincial compliance and supplier delivery as the operational system that must be contracted, controlled, and evidenced.

Recommended cooperation models (industry reference, non-prescriptive):

- Two-tier governance model: policy alignment layer (VNAT priorities, national campaigns) plus operations layer (province compliance, supplier delivery).

- Single point of operational control during live program: DMC as on-ground command with defined agency approval gates for client-impacting changes.

Handoffs and communication discipline (what “good coordination” looks like in governance terms):

- Pre-event alignment: shared responsibility map, escalation contacts, and approval authority matrix.

- Shared documentation spine: one RFQ/briefing pack version of record; one incident log version of record.

- Decision cadence: daily operational sign-off routine; change-control routing for client-impacting shifts.

Partner success and case-study potential (without stories):

- What can be documented for institutional learning: incident categories, resolution time, substitution outcomes, compliance checks.

- How to structure de-identified program learnings for future tenders: what changed, who approved, what evidence was retained.

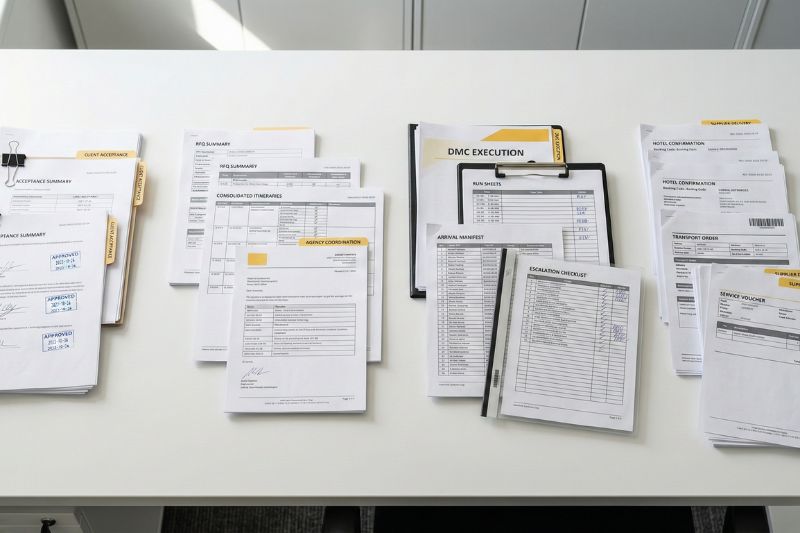

5. Governance documentation for Vietnam group and MICE programs under VNAT-led priorities

Briefing pack / RFQ essentials to reduce ambiguity (aligned with How Vietnam’s Tourism Structure Affects International Group Planning):

- Group profile: size, dates, language needs, accessibility, VIP handling parameters.

- Responsibility map: who owns flights, permits, suppliers, duty-of-care actions, and client communications.

- Risk matrix: scenario list, primary/secondary owner, escalation path, required evidence.

- VNAT-aligned considerations: MICE objectives, National Tourism Year destinations, and anticipated peak-demand impacts.

- Contacts and authority: named escalation roles, approval thresholds, and time-to-respond expectations.

Change-control rules that protect auditability:

- Triggers for re-approval: group size deltas, itinerary timing shifts, supplier substitutions, risk elevation (for example, weather alerts).

- Workflow: DMC proposes change in a tracked channel; agency (and client where required) approves; versioning recorded.

Incident logging and audit trail standards:

- Real-time log fields: timestamps, photos, decision owner, options considered, final action.

- Daily sign-offs: DMC lead and designated agency counterpart.

- Post-event review: issue taxonomy, root-cause notes, compliance check triggers where applicable.

- Retention and access: minimum retention period; who can access logs; privacy considerations for medical items.

Verification checklist before operation (freshness control):

- Confirm latest VNAT guidance after major events (for example, post-ATF cycle updates).

- Confirm provincial rules for venues/sites and any permit lead times.

- Confirm visa/e-visa and entry policy status via official portals before ticketing and final manifests.

6. FAQ themes (questions only, no answers)

- Which responsibilities in Vietnam group travel are governed centrally by VNAT versus enforced locally by provincial authorities?

- In contracts and RFQs, how should agencies define decision rights between the agency, DMC, and suppliers during live operations?

- What documentation is considered the minimum audit trail for itinerary changes, supplier substitutions, and incident responses?

- How should National Tourism Year campaigns affect destination choice, capacity assumptions, and lead times for group permits?

- When does a weather disruption become an authority advisory issue versus an operational rerouting decision owned by the DMC?

- Who owns duty-of-care actions for medical incidents, and how should privacy/consent be handled across borders?

- What are the most common failure points at the agency–DMC handoff (air-to-ground, manifests, timing buffers), and how can they be governed?

- How long should incident logs and sign-offs be retained for institutional compliance and client audit requirements?

- What should be re-verified close to departure given that promotional announcements may be current while operational rules evolve?

- How can planners structure de-identified post-program learnings to improve future tenders without relying on case stories?

EN

EN