Vietnam Peak Season Capacity Planning for Travel Agents

Category: vietnam-dmc-operations-and-planning Keyword: Vietnam peak season capacity planning Current year: 2026 Reading time: 35-45 min Vietnam peak season capacity planning is where series programs either scale cleanly or break under load. The same 20-40 pax template that runs smoothly in April can become operationally constrained during Tet, Christmas/New Year, and July-August when hotels sell out, transport and guide supply tightens, and site access gets congested. This guide is written for travel agents and tour operators running repeating Vietnam departures (weekly/monthly, 20+ departures/year). It is designed to be forwarded to clients or embedded into proposals to set expectations, lock booking windows, and protect service consistency across dozens of departures. It focuses on execution realities - booking windows, allotment structures, release terms, and capacity verification - not destination inspiration. If you also need routing discipline inside key hubs, use these operational playbooks alongside this article: Hanoi group routing playbook and hotel access and coach logistics playbook. In Vietnam, “peak” is not only a climate concept. It is a capacity compression problem: more demand hits the same hotels, cruises, vehicles, guides, venues, and flight seats at the same time. For groups of 20+ pax on fixed dates, this creates specific failure points: inability to confirm the same hotel across departures, forced coach downgrades, guide substitutions, longer transfer times due to congestion, and limited access to high-demand sites. For series planning in 2026, the three recurring pressure windows are: Tet (late Jan/early Feb) - closures and domestic migration drive the sharpest inventory squeeze. Public sources commonly reference 50%+ accommodation surges and widespread sellouts in key hubs during peak periods, with Tet being the most disruptive for operations due to shutdowns and labor scarcity. Christmas/New Year (Dec-Jan) - high international demand, especially in Hanoi and Ho Chi Minh City (HCMC), plus strong leisure demand in beach/island hubs. Expect price uplifts and reduced flexibility on preferred hotel sets. Summer (Jul-Aug) - school holiday demand concentrates in central beaches and islands. Availability, flight inventory, and resort minimum stays can become the limiting factor more than sightseeing capacity. Demand mix matters because it determines what gets scarce first. Typical patterns referenced in market summaries: Europe/North America drive a significant share of Dec-Feb travel; Australia/China and regional school holidays drive much of Jul-Aug beach demand; domestic travel spikes multiple times around Tet. The implication for series programs is straightforward: supply tightens across the whole chain, and last-minute substitutions tend to reduce consistency across departures. Capacity facts are often not publicly verifiable (coach parking quotas, site caps, boat grouping rules, venue maximums). For proposals and client-facing documentation, treat any public numbers as assumptions and validate via: Vietnam National Administration of Tourism channels (vietnam.travel), provincial tourism authorities, site management boards (e.g., Halong Bay Management), venue operations teams, and airline group desks. Seasonality references commonly cited in trade-facing travel summaries include VietnamTravelOnline, Goway, Lonely Planet (updated Dec 2025), and Audley Travel. For 2026 contracting, confirm exact Tet dates and supplier policies at time of booking. Series success depends on aligning your client sales calendar with Vietnam’s supplier contracting calendar. If your agency sells repeating departures, you are not “booking trips” - you are managing inventory across time. The goal is consistent delivery across all departures, not a perfect solution for one date. Use these planning windows as operational guardrails (then adjust based on your hotel tier, language requirements, and routing): Tet and Christmas/New Year: plan to secure hotel and cruise inventory 9-12 months ahead for 20-40 pax groups. Risk pattern: preferred properties can be fully committed by 6 months out, leaving only high-rate options or split-stay solutions. Summer (Jul-Aug): plan to secure beach/island inventory 6-9 months ahead, especially for weekends and popular resort hubs. Expect steeper uplifts and tighter release terms than shoulder months. Shoulder months (Apr-Jun, Sep-Nov): typically offer more pricing stability and higher substitution flexibility, which is why they are the best “buffer capacity” for a series portfolio. Where a DMC can still create solutions when inventory is tight: Client-facing takeaway you can use in proposals: Peak dates in Vietnam are not “first come, first served” at the itinerary level. They are “first blocked, then sold” at the inventory level. A scalable Vietnam series plan uses an annual calendar with clear “red zones” (high risk) and “green zones” (operationally efficient). This helps you set client expectations, decide where to price-protect, and decide where to keep flexibility. Red zones are dates where you should assume: limited inventory, higher uplifts, stricter release/penalty terms, and reduced ability to keep the exact same supplier set across all departures. Green zones are where you can scale departures without eroding margins or service consistency. Many agencies use these windows to run higher frequency, then keep peak dates as premium-priced “limited departures.” For repeating departures, the goal is to keep your client-facing promise stable while giving operations pre-approved levers. We recommend designing: Example substitution logic (pre-approved): Halong Bay overnight cruise (capacity-constrained, coach congestion risk) ↔ Ninh Binh (Trang An / similar water-based experience, different logistics, often easier to secure in some peaks). Hoi An (pedestrian restrictions, peak crowds, limited coach access) ↔ Hue (more coach-friendly routing options for groups, different site operating hours and ticketing approach). Nha Trang/Da Nang (summer beach demand + monsoon buffers) ↔ Phu Quoc/Con Dao (alternate island capacity, flight considerations, different contingency plans). Client-facing takeaway you can use: We do not change the product promise. We change the logistics module when capacity risk spikes. Tet is the highest-risk period for series operations because it combines demand spikes with operational shutdown patterns. Public travel references commonly cite 7-10 days of closures affecting many museums, restaurants, and services, plus nationwide transport demand increases. For a fixed-date series group, the main risks are not “crowds” - they are unavailable suppliers and reduced service consistency. Tet can be sold successfully when positioned as a controlled-scope departure with explicit inclusions and limits. Client-facing positioning that reduces dispute risk: If your series brand promise is “predictable execution,” avoid building Tet programs that depend on: Option A: “Tet Atmosphere” departure (limited, premium priced, controlled scope) - sell with explicit closure expectations and pre-confirmed inclusions. Option B: “Post-Tet Certainty” departure (Feb/Mar) - sell as a consistency-first series: stronger supplier availability, often improved value versus peak, and less itinerary disruption risk. Christmas and New Year in Vietnam is typically a high-demand window, especially for Hanoi and HCMC, with leisure peaks extending into beach and island stays. Operationally, this period usually has fewer hard closures than Tet, but it introduces a different series risk: inventory rigidity. If your preferred hotels are not blocked early, you risk either overpaying or splitting the group across inconsistent properties. For repeating departures, keep city components short, tightly booked, and operationally conservative: For client proposals that require sun-focused extensions in late December or early January, agencies commonly evaluate island/beach components and Mekong routing as alternatives to over-concentrating on Hanoi/HCMC. The operational value is not “prettier beaches” - it is program stability and venue capacity with pre-booked services. If your series includes a welcome dinner, year-end dinner, or short briefing-style event, treat it like light MICE: confirm venue load-in rules, AV vendor availability, and staffing. Around year-end, venue calendars fill early. Summer peaks are driven by school holiday demand and concentrate heavily in beach hubs. Two operational realities matter for series planning: For 20+ departures/year, consistency comes from standardization. We recommend locking these rules into your series SOP and client proposal notes: Vietnam’s regional weather patterns can impact routing decisions. Public references frequently note summer rain patterns and increased storm risk later in the season (Aug-Sep), plus flood risk in parts of central Vietnam later in the year. This does not mean “do not operate,” but it does mean your proposal should document that the itinerary includes pre-priced substitutions for weather safety. Peak capacity planning becomes manageable when you treat inventory like a portfolio: some dates are fixed and must be protected with blocks, while other dates are deliberately held flexible to absorb demand or supplier failure. The objective is to guarantee operability without overcommitting cash flow or taking avoidable penalties. Use this sequence for 2026 series programs: Peak allotments often carry non-refundable exposure. Public summaries commonly reference 20-50% penalty ranges depending on supplier and timing, but your contract terms will vary. For evaluation-stage planning, aim to negotiate: For agencies running 20+ departures/year, we recommend holding: Client-facing takeaway you can use: We protect holiday dates with confirmed inventory, and we protect value with shoulder-date buffers. When agencies manage 20-50+ departures, the main operational risk is not lack of effort. It is manual tracking across too many moving parts. The solution is to standardize what “ready” means, then manage by exception (only flag what is off-track). A practical dashboard structure uses a departure ID and a readiness score built from time-stamped confirmations. Minimum fields for a Vietnam series: Exception-based management works when alerts are specific and actionable. Common peak-season alerts for Vietnam series: To keep series quality consistent, track performance the same way you track inventory: If you want an example of a structured toolset built for agents, see the Dong DMC Agent App page for the type of operational workflow we support (series readiness, confirmations, and exception handling). Peak season failures in Vietnam series operations usually come from predictable pressure points. Planning around them is a proposal-level advantage because it sets expectations and reduces on-the-ground improvisation. Examples of constraints frequently encountered in peak periods (validate per site and date): For proposal language: “Local access restrictions may require short shuttle or walking segments; these are planned in advance and do not affect inclusions.” Timing risk is predictable and should be written into the operating plan: Many series programs include welcome dinners, short briefings, or small recognition moments. Treat these as operational production, not a casual add-on: For a broader risk view you can cite internally, see: Vietnam traffic and protocol risks playbook. Series operations need reusable contingency patterns. The goal is not to predict every disruption, but to define triggers, substitutions, and approval flows so your team is not reinventing decisions for each departure. Use a simple trigger structure in your internal SOP and client documentation: Plan B inventory: pre-contracted alternates (examples: Ninh Binh vs Halong; Con Dao vs Phu Quoc) that are priced and described in advance. Plan B routing: reverse sequence (north-to-south vs south-to-north), or add a one-night staging city to protect flight connections. Plan B program blocks: indoor-capable activities and venues that can replace weather-exposed components without changing the overall inclusion count. For peak season proposals and contracts, align insurance and terms with realistic disruption scenarios: When peak hits, supplier scarcity is predictable. Your series reliability depends on whether you designed redundancy and standards into the program from the beginning. For agencies running repeating departures, a “guide” is not a single assignment - it is a controlled roster. Recommended operating pattern: Peak periods strain vehicle supply. Reduce risk with: A scalable reconfirmation rhythm reduces surprises. For repeating departures, we recommend an SOP cadence that suppliers recognize: Below are proposal-ready case angles you can adapt. They are structured to demonstrate control: what was blocked, what was released, what was substituted, and how workload was reduced. Scenario structure you can use in a client pitch: Before/after metrics agencies typically track (use your own numbers): Controlled substitution example structure: For execution references, see partner success stories (case formats and operational detail levels that agencies often cite in proposals). This checklist is designed for agencies managing repeating departures. Use it internally or attach it to client-facing planning notes to show control and reduce expectation mismatch. T-12 months (peak dates): block hotel sets by city; block cruise inventory (if applicable); open airline group requests; secure coach contracts; define guide pool by language; define Plan B modules and pricing. T-6 months: pickup review vs allotment; execute staged releases; confirm venue/menu placeholders; hold alternate inventory in shoulder months for overflows; confirm holiday closure assumptions. T-90 days: finalize key suppliers; confirm penalty exposure; assign primary guide and coach; confirm any permits/tickets; activate exception alerts. T-30 days: confirm rooming list process; confirm dining capacities; confirm timed entries where relevant; validate pedestrian-zone and coach access rules for each stop. T-7 days: full reconfirmation sweep; weather monitoring triggers; reconfirm contingency activation rules; finalize operations pack. T-1 day: arrival flow confirmation; bay assignments; signage readiness; final supplier reconfirmations. Before contracting or publishing client materials, verify the following with the appropriate authority or operations team (not from generic web sources): If your agency runs repeating departures, SOPs protect your brand by making outcomes less dependent on individual heroics. These modules are designed to be signed off by suppliers and used for training and audit. For partners evaluating a white-label delivery model, see why partners choose Dong DMC (how we protect partner brands operationally). Q: How far in advance should we block hotels and cruises for Tet vs Christmas vs summer for a 20-40 pax series? Use Tet and Christmas/New Year as 9-12 month block-first windows for groups, because preferred hotel sets can be fully committed by around 6 months out in key hubs. For summer beach hubs (Jul-Aug), plan 6-9 months ahead, especially for weekends and high-demand resorts. Shoulder months (Apr-Jun, Sep-Nov) are ideal for buffer capacity and lower-penalty flexibility. Q: What is the realistic Tet shutdown impact, and can we still sell Tet departures? Plan for 7-10 days where many independent businesses may close or operate with reduced service, and staffing availability can be constrained. Tet departures are sellable when positioned as a controlled-scope product: pre-confirmed dining, fewer museum dependencies, clear substitution clauses, and higher coordination coverage. If your brand promise is strict predictability, position Feb/Mar as the “post-Tet certainty” series window. Q: Where do we route overflow when Halong Bay or Hoi An is full without changing the brochure too much? Use pre-approved modules that preserve nights and inclusion count: Halong Bay overnight cruise ↔ Ninh Binh module; Hoi An ↔ Hue module; central beach hubs ↔ Phu Quoc/Con Dao (with flight considerations). The key is to pre-price and pre-describe these substitutions so your sales team can present them consistently and operations can execute without day-of renegotiation. Q: What buffers should we add for monsoons/typhoons and summer flight disruption? Standardize buffers in your series SOP: (1) a weather trigger that activates Plan B excursions, (2) transfer buffers for peak weekend congestion, and (3) a flight schedule change protocol that automatically recalculates meals and ticket timings. Treat weather-sensitive components as modular blocks with indoor-capable alternatives, not as fixed promises. Q: How do we keep guide quality consistent across 20+ departures? Run a dedicated guide pool per language with backups, use a standardized briefing script, and track guide performance using the same discipline as inventory: punctuality, guest feedback, issue tags, and incident counts. The objective is to reduce variance across departures, not just fill dates. Q: What attrition/release terms are typical, and how do we reduce penalty exposure? Peak terms vary by supplier, but penalty exposure can be significant (often discussed in the 20-50% non-refundable range depending on timing and property). Reduce exposure with staged releases (example: partial at 6 months, full at 90 days), attrition bands aligned to pickup, and a defined hotel set so substitutions remain equivalent rather than disruptive. If you are running 20+ Vietnam departures per year, we can build a 12-month series departure capacity plan: peak/shoulder calendar, allotment map by city, backup supplier matrix, and an exception-alert workflow to reduce manual tracking. Fast quotations. Brand-protected operations. Zero missed arrivals. Seasonality patterns, peak demand windows, and general uplift references are commonly described in trade-facing travel summaries, including: Operational capacities (site caps, coach access limits, port rules, venue maximums) are not consistently published and should be verified for 2026 programs via Vietnam tourism authorities (vietnam.travel), provincial tourism bodies, site management boards, venue operations teams, and airline group desks. Use this article as a planning framework, then validate the facts per itinerary and departure date.

Planning Takeaways

1) What “peak” means operationally (for series buyers)

2) Booking window realities for repeating departures (20+ per year)

3) Peak calendar design for series departures (template + variants)

3.1 2026 red zones (capacity compression windows)

3.2 2026 green zones (series-friendly operating windows)

3.3 Base itinerary architecture that scales (keep brochure stable, protect operability)

4) Tet playbook (late Jan/early Feb): what to sell vs what to avoid

4.1 What to position as a sellable Tet product

4.2 What to avoid for “operational certainty” Tet departures

4.3 Best practice: split your series proposition into two Tet-adjacent products

5) Christmas/New Year playbook (Dec-Jan): routing logic that protects consistency

5.1 City time discipline (Hanoi/HCMC)

5.2 Sun stability routing (beach/island + Mekong options)

5.3 Contracting note for year-end events

6) Summer playbook (Jul-Aug): booking windows, beach capacity, and weather buffers

6.1 What to standardize across all summer departures

6.2 Routing reality: summer is not one climate zone

7) Allotment strategies for agencies running 20+ departures/year (actionable, repeatable)

7.1 Step-by-step: 12-month block strategy (hotels, cruises, transport, guides)

7.2 Release, attrition, and penalty structures (profit-protection, not paperwork)

7.3 Portfolio approach: buffer inventory and overflow routing

8) Consistency and scalability tools (exception-based series management)

8.1 Departure readiness score (what to track for every series departure)

8.2 Exception alerts (reduce manual follow-ups)

8.3 Quality consistency tracking across departures (reduce variance)

9) Operational considerations: what breaks first in peak periods (and how to design around it)

9.1 Access logistics constraints (group movement realities)

9.2 Timing risk: closures, reduced hours, and staffing gaps

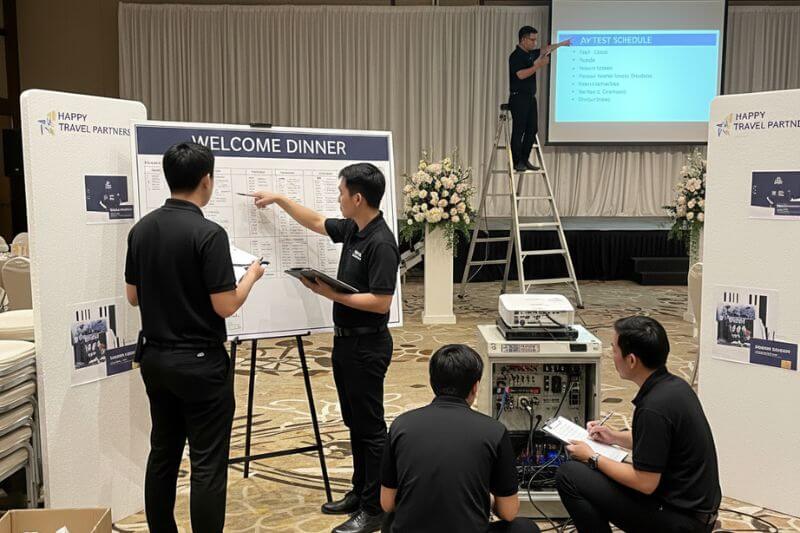

9.3 Technical production considerations for “light event” moments

10) Weather and disruption planning that can be repeated across departures

10.1 Seasonal risk triggers (proposal-friendly)

10.2 Reusable contingency patterns (operationally proven structure)

10.3 Insurance and contractual protections (evaluation-stage essentials)

11) Staffing, transport, and service-level consistency under peak load

11.1 Guide pool stabilization (reduce quality variance across departures)

11.2 Coach and driver planning for 20-40 pax (avoid single points of failure)

11.3 Reconfirmation cadence (the series standard that prevents day-of surprises)

12) Case application ideas (how agencies use this in proposals)

12.1 Locking peak inventory without locking risk

12.2 Exception-based series ops reduced manual workload

12.3 Peak season substitution that preserved guest satisfaction

13) Vietnam peak season capacity planning checklist (copy/paste for series teams)

13.1 Timeline checklist

13.2 Capacity verification checklist (validate facts vs assumptions)

14) Standard series SOP modules (for consistent delivery across departures)

14.1 Arrival flow SOP (airport to hotel)

14.2 City touring SOP (timed entries, breaks, and pickups)

14.3 Dinner/event SOP (menus, AV, seating)

14.4 Incident SOP (medical, delays, supplier failure)

Frequently Asked Questions

Talk to a Market Specialist (Series Capacity Plan for 2026)

Sources and verification notes (for proposals)

EN

EN